Insurance Advisers vs. Direct Providers: NZ Guide

Choosing insurance in New Zealand?

Here's what you need to know:

Insurance advisers are middlemen who help find policies

Direct providers are companies you contact yourself

NZ insurance covers travel, health, home, car, income protection, and life

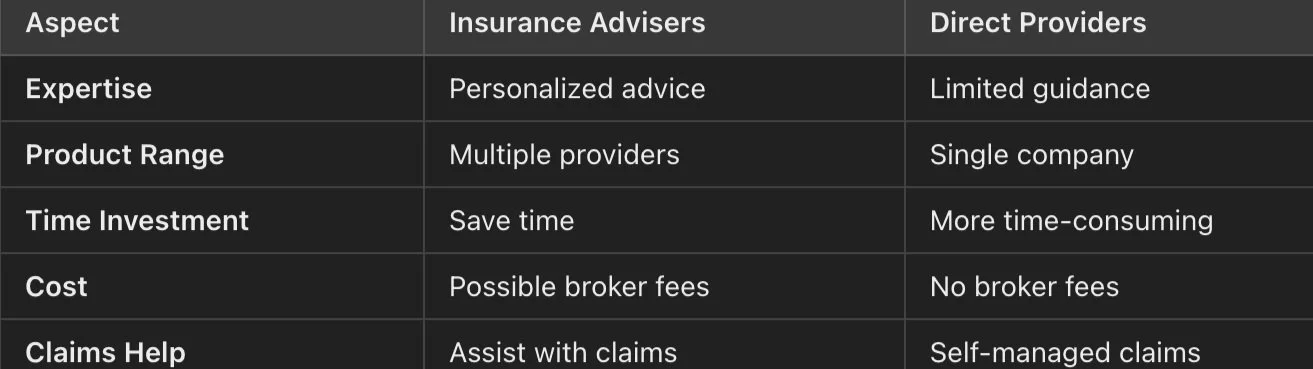

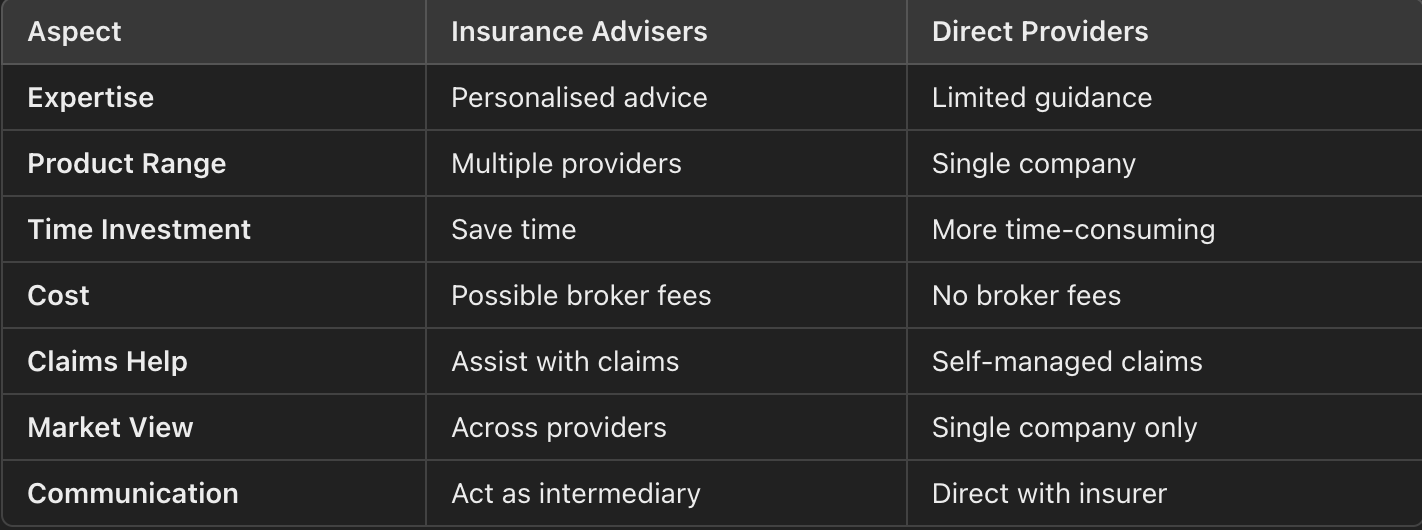

Key differences:

Insurance advisers in NZ are typically free, paid by commissions from insurers.

Bottom line: Choose based on your needs, budget, and desired level of support.

Insurance Advisers

Insurance advisers in New Zealand are your go-between with insurance companies. They're not tied to one insurer, so you get more options.

What do they do?

Check what insurance you need

Find policies that fit you

Explain tricky terms simply

Help with claims

It usually takes 2-3 meetings. They'll ask about your health, money, and goals to give the right advice.

Why use an adviser?

Saves time: They do the comparing for you

Know their stuff: They understand policies inside out

Keep helping: Many check in as your life changes

But heads up: some work on commission. This might sway their advice.

"An insurance adviser is a go-between who deals with insurers to arrange your insurance." - Financial Markets Authority

Types of advisers:

Independent Insurance Advisers

Company-specific advisers (like Chubb)

Each has its good and bad points. Chubb advisers, for example, don't get commission. This could mean less biased advice.

What to expect:

They'll ask about your:

Income

Job

Money goals

Health history

Be honest about health issues. It helps them find the right cover and avoid surprises.

Choosing an adviser:

Check their qualifications

Ask about their experience

Read what clients say

Know how they get paid

Remember, NZ's Financial Markets Authority keeps an eye on advisers. They have to follow strict rules to protect you.

Next, we'll look at direct insurance providers. This will help you weigh up both options.

2. Direct Insurance Providers

Want to skip the middleman? Direct insurance providers let you buy policies straight from the source. It's often quick and easy, but there are pros and cons.

The Good:

Fast: Many NZ insurers offer online quotes and purchases

Control: You pick which companies to check out

Simple: If you have experience you may not want or need to shop around

The Not-So-Good:

Limited view: You only see one company's products at a time

Less guidance: You might miss out on personalized advice

Jargon jungle: Insurance terms can be tricky to navigate solo

"Buying direct from a life insurance company may mean missing out on the personalized experience you'd get with a broker." - Financial Markets Authority

Going Direct? Remember:

Get at least three quotes

Check what's covered (and what's not)

Ask about unclear terms

Review your cover after big life changes

Keep in mind: Some insurers only sell through brokers. And be careful with online forms - missing details could cause headaches if you need to claim later.

Compare Insurance Options and Save

Get expert insurance advice tailored to your needs for free. We’ll connect you to a trusted insurance advisor to find the the best value for money policy for you.

Good and Bad Points

Let's compare insurance advisers and direct providers in New Zealand:

Insurance Advisers

Pros:

Expert guidance

Wide product range

Time-saving

Claims support

Cons:

Potential fees

Less direct control

Direct Providers

Pros:

Possible savings

Direct insurer contact

More control

Cons:

Limited comparison

Complex terms

No personalised advice

"Buying direct might mean missing out on a personalised experience." - Financial Markets Authority

Which option fits YOU best? It depends on your needs, budget, and how much help you want.

Wrap-up

Choosing between insurance advisers and direct providers in New Zealand? It's all about what you need, what you can afford, and how much help you want.

Insurance Advisers: Your Personal Insurance Guide

These folks offer:

Expert advice just for you

Lots of options from different providers

Help when you need to make a claim

Your best bet is to take the quiz at Insurance Genius to get connected with an independent expert who will find you the best value for money cover.You don’t have to do any of the heavy lifting and you’ll have the confidence that comes with having an expert in your corner.